I favor modeling the economy as a time dependent, multidimensional, dynamical system.

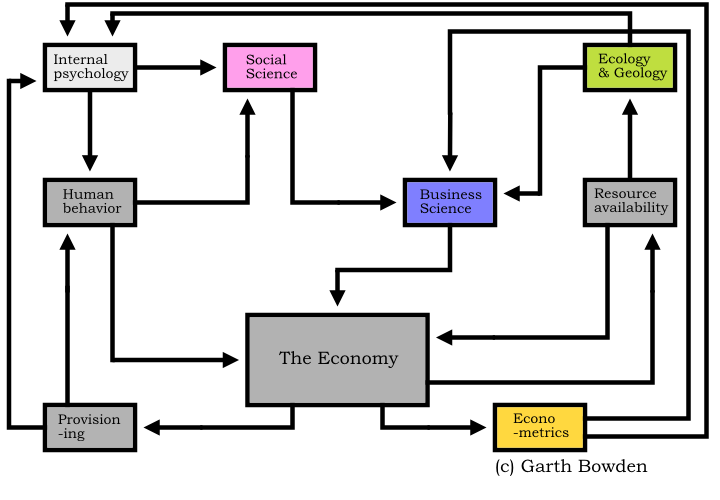

Here's a diagram:

The central box, The Economy is everything that actually happens. The colored boxes are schools of thought used by individuals in decision making. The boxes in dark gray are the orthodox boxes, the material elements of the economy. Note that the human behavior box is orthodox but that the internal psychology box is light grey. This reflects the tradition of using a simple, behaviorist model of "utility" to model preferences. I reject that tradition and so group human activities into quantifiable behaviors as well as cultures and thought patterns which might be evaluated at a qualitative level.

This chart can further be taxonomically divided by cycle type.

There is only one two cycle, which is between The Economy and Resource Availability. This reflects the hard fact that our economy is directly constrained by resources.

There are several three and four cycles. These reflect the passing of information from one field to the next. Groups that recieve the data are dependent on the analysis made by the group that passed the information to them. For instance, econometric data is gathered from the economy itself and then analyzed before being passed on to the businesspeople. People educated in business do not specialize in economic trends but instead depend on economic and statistical assessments made by people who can do econometrics. Therefore, our economy is not at all self contained but is significantly influenced by a very broad set of factors and schools of thought.

For better or for worse, I have grouped some things in. Government regulations should fit into their appropriate sphere. For instance, funding for environmental research would fall under Ecology and Geology. Minimum wage laws would fall under Business Science and Provisioning.

In order to develop this model further I will need to move on to conceptualizing the actual functions involved. Of greatest interest to me at this time is the possibility of using a leontief type input output model to feed data from The Economy to the other squares, which would then modify the data according to policies and practices used in each field. The series would convert data back to the apropriate input type for the leontief model as cycles returned to the central square.

1 comment:

Yes, I agree that orthodox economics oversimplifies human behavior. After all, they didn't have very good computers when they came up with this stuff.

Sounds like you are interested in behavioral economics.

You might also be interested in Simulacra, an online community intrested in developing open-source modeling of climate problems.

Post a Comment