Every dollar spent is split between savings and demand. Savings is the variety of ways that the dollar is retained for later. This may be a variety of things, ranging from pure investment to stashing, to what amounts to demand increases.

Demand is the ways that money leaves the hands of the individual. Demand has three components: taxes, autonomous spending, and consumer spending.

Returning to the income equation, we have the following: 1 = S + D ; Which when D is analyzed for its savings component gives S + D(S + D(S + D(.... = S + SD + SD^2 + SD^3... which is easily verified to equal 1.

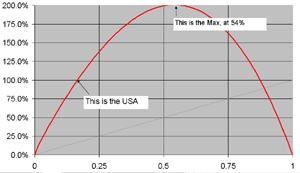

From this we can make an incentive hypothesis. Laffer made one, because without it there would be no Laffer curve. His is simple, and it says that as the tax rate increases, the incentive to produce wealth decreases. Incomes will decrease and therefore so also will marginal tax revenue, creating a parabola. There is a significant problem here, that as tax rates increase we do not know whether incentives will decrease uniformly. It seems to me that they will not, and various criticisms of the Laffer curve simply shift the peak out of symmetry, usually toward the higher tax end.

The meat of my version of this model is to assume that individuals are ambivalent between money spent autonomously and money taken as taxes. Furthermore, diminishment of income should spurn compensatory increases in wages, which would drive up prices, and lead to a certain forced reduction in real autonomous spending. Finally, we assume, as Laffer did, that when incentives are zero, production is zero. There is nothing wrong with the claim, but it is probably impossible to bring such a situation about. In fact, if you consider that the economic models take all of our desires into account, some of us will be raving nationalists and work out of altruism which cannot be effectively taxed to zero. This impossibility opens the door to discontinuity in the graph as tax rates become higher.

I intend to make a model that also explores a second criticism (in a certain sense). We postulate that changing the tax rate changes consumer spending but does not change autonomous spending. Depending on the savings level, the increase in taxes will mostly be taken out of savings, or mostly be taken out of spending, with the equilibrium savings rate being a function of the tax rate. The foreign components are leaks of money out of the economy, making them another key aspect of what the maximum will be. Even though the US savings rate is like 0% I'm going to pretend we have a savings rate of 4%. As a function of the tax rate, the savings rate will decline to zero more or less asymptotically.

So, to start my model, first i find the tax rate. We know that total government revenues for 2006 (a good data year) were 2.2 tril, and the GDP that year was 13.1 tril, giving an effective tax rate of 16.6%. Because the data I can get for autonomous spending includes some uber-right wing assumptions, I'm going to go with what I was looking at when I lived alone. Mine was about 43% of my income (I'm not including taxes in this!), meaning 43 cents out of every dollar went to food, bills, and rent. If I add in my student loans (which I am paying now but were still in their grace period the last time I was employed), the number jumps even higher!

Next, I denote four component demands, each being a function of different variables. These demands have a stimulus effect on the economy that is a constant calculated from econometric data. Dt, the tax generated demand, will be demand generated by government programs. We can expect this to be the highest; one study found that every dollar spent on government programs produces 1.4 times as much stimulus as a dollar spent in the private sector. We know private sector spending, thanks to my handy calculation taken from my own expenses, is divided up about evenly between autonomous and free spending. I will assume that free spending has twice the stimulus effect of autonomous spending. From this, we deduce that autonomous spending would have a constant of about 2/3 and free spending would have a constant of about 4/3. Finally, domestic investment will be a function of savings and will have a constant of 0.9, which is a number I just made up.

Percentage change in the four component demands creates a relative scaling of the GNP. Hence, if the total Dt+Da+Dc+Di were to increase by 10%, the GNP would increase by 10%. This is then multiplied by the linear decrease in output produced by consumption decreases. This is the roughest part of the model, and I would have to do a lot of research to come up with something better.

Finally, everything is multiplied together to get a relative change in revenue, with 100% being our current situation.

So, how does my graph compare to Laffer's?

It is worth noting that the maximum here at 54% is not the nominal tax rate of 54%, or the top tax bracket being at 54%. This is the total of all revenues divided by the GNP. This doesn't have any impact on tax equity; in fact I am tacitly assuming something like a flat tax, and the number might be higher than 54% if most of the income is collected from the rich. So, at the very least, we could double our tax rate in America and expect to gain about 75% more revenue. We can also boldly pursue a much more progressive tax code.

My personal hunch is that if we could reduce autonomous spending in the real economy, it would be a huge economic boost. My favorite plan for this is government land purchases. Ideally, the government could be our landlord. That's one of the biggest disconnects between democracy conceived and implemented. If we control the government, shouldn't it be in control of something?

No comments:

Post a Comment